In the next installment of our Innovator Interview series, we recently met with Dan Garrett, CEO at Farewill.

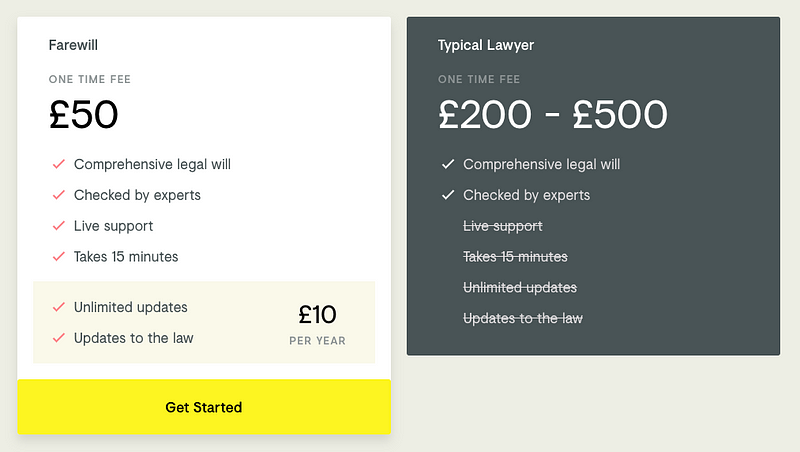

Farewill is a subscription-based digital will writing service that aims to help people save time and money, gain piece of mind and have increased flexibility and choice when it comes to writing their will.

Where did the idea to start Farewill come from?

I studied Global Innovation Design at the Royal College of Art which was split between Tokyo and London. I was basically focused on identifying services and products that would potentially have global applicability.

Part of my time was spent working in an old people's home in Japan and I couldn't help but notice that a huge amount of time was spent on the still important, but superficial aspects of ageing like getting out of bed. For cultural and practical reasons, there was no real acknowledgement of the fact this was a group of people scared of the fact that they could die with unfinished business in terms of their close friends and family. There seemed to be no productive way to address this and I left feeling like I hadn't done my job as a designer to help deal with the problem.

Once I got back to the UK I gained a lot more insight into this area. I organised 15 funerals and I received a qualification in will writing. I got to see and understand what the current customer experience was like and I felt like the whole industry was antiquated. There's also an element that I don't think many people realise in terms of the business model that surrounds death.

In many instances private equity firms have taken advantage of the fact that people often don't 'shop around' when it comes to things like organising a funeral. So you can end up with the whole process at a local level, from funeral services to solicitors being controlled and the prices raised for services that we'll all need eventually. Right now 100,000 people in the UK go into debt each year paying for funerals. I felt like people deserved a wider range of options in this whole area.

I found it fascinating that this industry, one of the very oldest and the subject of many of the greatest works of art, literature and philosophy has remained relatively untouched from a consumer brand and technology perspective. Combined with what I saw as a broken market that no one really talks about, I saw an opportunity. People need an answer to the service beyond simply using the local solicitor by default.

What are the alternative options currently?

Well in 2017 we actually became the biggest will writer in the UK, which shows how ready the market was for this kind of offering. In terms of other options, there's obviously local solicitors, which will tend to be expensive and disparate in terms of quality. CoOp Legal Services are very good and that tends to be where we refer people if their circumstances mean we're not the best option for them.

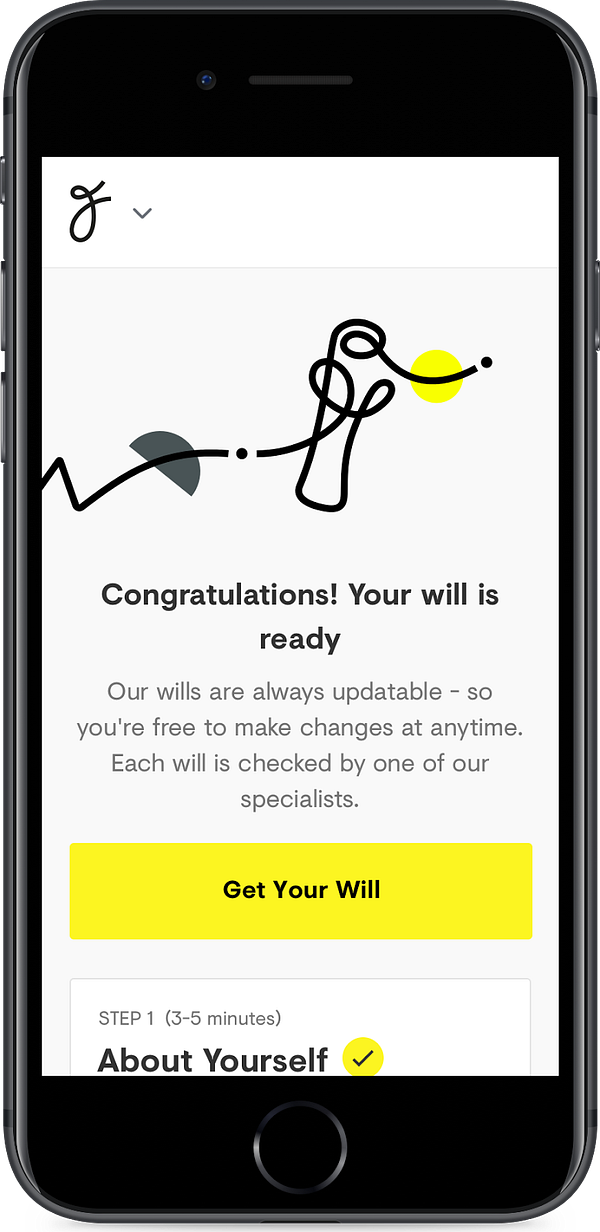

Most online offerings will have a terrible UX and no real support beyond the form itself. This was something we learned in building Farewill. We found it difficult to hit our targets in terms of what the process should feel like from a user perspective without having someone always available to talk to and having that human element to the experience. Every will here gets checked by a specialist and we have phone lines open 7 days a week and 12 hours a day.

Do you have an ideal or target user group?

Well 75% of our current customers are under 50. We've found that people taking on new responsibilities and going through or having just gone through major life events such as buying a house or having children are the points at which people usually feel like a will is something they need. For people that haven't had a will before, we find that this group is incredibly receptive to how easily, affordably and quickly we can get them set up.

The convenience we offer also means we have a sizable user base of people in their 70s and 80s who are tech savvy and appreciate not having to go through such a complex and expensive path again if they want to make changes to an existing will for example.

The Farewill Team

The Farewill TeamWill-writing (and death more generally) is a tough and often touchy subject. How do you achieve a positive brand impression in that environment, convey that you're a tech company offering something fresh and new but not overstep the mark?

We'll typically have at least one phone call a day with someone in a terminal situation. It's impossible in that context not to appreciate the gravity of what that person is going through. The completely informal, jokey tone of voice you see a lot of tech startups adopt obviously wouldn't be appropriate for the sector we're operating in.

We're proud of what we're able to provide people with — often saving people up to £10,000 if they were to die through the combination of a reduction in legal fees and preventing lost assets. We help people write wills, and we try to do this in a way that's as human as possible.

People don't expect their will provider to be cracking jokes, but we like to think we can adopt the tone of a trusted friend or family member. People are naturally more receptive to this tone of voice than the inaccessible legal jargon that people have traditionally been faced with when looking to write a will.

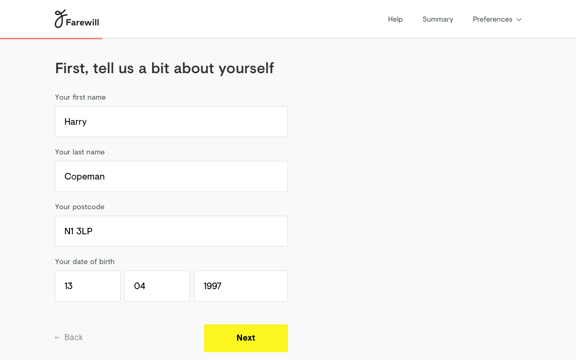

From a pure brand perspective, we've spent a lot of time making Farewill look and feel like it fits within a suite of digital services that people are used to, comfortable with and even expect to use. This is a really interesting area of brand for me, with the goal being a feeling of familiarity, even if someone hasn't used your service before.

We made a conscious decision to distance ourselves in terms of things like colour palette from what people currently associate with wills and related services. It's subtle, semiotic references like this that can add up in terms of brand perception without having to use big clumsy cues. We can come across as fresh and new by looking more like friendly, customer focused services people are already familiar with than a formal solicitors website for example.

An example of the simple Farewill process

Something I read prior to meeting you was that you try and approach will-writing from a 'human' perspective rather than one of legal compliance — can you elaborate on what you meant by that?

I think the easiest way to explain this is comparing us to traditional providers. Traditionally the goal is simply to produce a legal document, but this doesn't reflect how we as people actually experience and think about what we want to leave for our loved ones.

We have another set of KPIs.

- The percentage of people that include a friend in their will

- People that leave personal messages for loved ones and not just money and assets.

What people really care about in the context of them potentially dying is different from simply a document. It's about human relationships and the legacy and memories you'd like to leave — it's not about legal jargon. What I noticed was that visiting a solicitors is typically a formal exercise in legal compliance, completely ignoring the human element of that experience. The knock on impact is that people naturally go along with this impersonal context, and it impacts their wills.

Only 7% of people currently include charities in their will. With Farewill, 70% of people include a friend or a personal message and 32% leave a gift to charity. Last month alone we raised over £8 million for charity. We've also noted that our Net Promoter Score goes through the roof when people engage with these aspects of the product. People like to feel empowered and Farewill offers the chance to really think about what's important.

Why do you think more people leave messages and include friends more frequently using Farewill?

The traditional legal model for writing a will is based around the family structure. We do that too but we also offer a clearer way of adding a person that isn't necessarily family. Like I alluded to earlier, when faced with legal jargon and such a formal setting, people will usually simply work within the provided structure rather than try and change it. We provide a different mental model where you're not led into such set ways of thinking.

Also, just not being sat in front of a lawyer in that environment means you can think more clearly and in a more self reflective way. We actually prompt people as to whether they'd like to consider leaving anything to a charity — just to be sure they've considered it. This also links to our partnerships. Macmillan is currently running a free wills month for example for which we are the main partner.

How do you respond to scepticism towards a digital-first platform compared to the expertise of a solicitor sitting down with that person?

There are certain conditions that will mean Farewill isn't the best option for you right now (we're working on it though!) — and we'll be the first to tell you that.

If someone has to pay inheritance tax for example, this can complicate a will, but this is currently only 3% of people in the UK. It's a similar story for those with disabled dependents, complex foreign assets or the super, super wealthy — but these are minorities.

For the vast majority of people, we encourage them to compare our service to what you'd get elsewhere and make their own decision. There are many families out there being left high and dry when someone passes away without a will. This is the real scenario and the legal industry has historically had no answer.

What are the biggest roadblocks to Farewill?

For the majority of people, a will is something that is seen as important, but not something that's urgent or an exciting purchase. On average people wait 7 years between being aware that they need a will and actually doing it. A lot of the people we're trying to serve are in this group that don't need convincing it's important, but require persuasion that a will is something to move from their to-do list B, to their to-do list A.

This is a product and a marketing challenge, particularly as we grow and we gain more users. Our market essentially becomes those that still haven't completed their will, so we move to people with decreasing levels of urgency to complete a will. So there's a solid marketing, education and product experience piece there to appeal to these people.

Another KPI we have (and one that's been a solid marketing lesson) is of people that rate the importance of having a will as high but their motivation to actually do it as low — what's the lowest level of motivation we can actually run through our whole process? They know it's something they need, but it's the lack of urgency that is the barrier and we want to be able to display how easy it is.

I saw that you're building a lot of partnerships with HR-focused platforms, offering the service as an employee perk. Was this a strategy from the outset, or something that built over time through circumstance?

Well there's a lot of synergy there with other products. When people take out a life insurance policy for example, they often receive something like a £50 M&S voucher. Everyone loves M&S obviously, but for that same value (a will is £50 with Farewill) if you could package a free will… That's a really tangible and relevant perk.

There's also the side of companies wanting to offer their employees something of real value, that they might not already have (like a will). From a business perspective, this also creates a new market for us that isn't faced with the same kinds of motivational diminishing returns as the consumer side.

What's the most important lesson you've learned building Farewill?

I've learned a lot about talent and hiring. I feel like the best hires are when you can closely align the goals and aspirations of those joining the company with the company itself. What someone wants to achieve, explore and learn is important to consider, and hopefully will be close to how you envision their role developing. We've learned obsessively about hiring and managing talent with help from our investors because we understand how important getting our team right is.

The other thing that's been interesting for us is comparing how we've grown to others that have a technical founder. Until just a few months ago my Co-Founder (our CTO) was our only engineer. Now, he really has been doing the work of about 3 people, but with a technical founder, businesses often go engineer-heavy from the outset. The problem I think with doing that is really knowing what to build and validating why. There's a careful balance between product development and engineering. We've really tried to instill a culture of knowing exactly why an improvement or build is happening. There's a real danger of filling engineering capacity because it's there rather than because it's needed.

Do you have any other thoughts on what's going on in legal tech at the moment?

Well I guess the first thing I'd say is that we don't really label ourselves as 'legal tech'. I think this kind of grouping is more useful to people within tech than to actual users of the products. We're simply a solution to a problem that people have.

That said, I think there are going to be plenty of opportunities wherever law deals with consumers. Whether that's buying a house, getting divorced or anything like that. There are so many ways in which technology can make these things quicker, easier and cheaper.

There's an interesting talking point in corporate law where the existing structure seems to be an enemy of progress. All the big firms have the same motivations not to change — why would they want to create efficiency savings and minimise their hourly billing model? This continues to serve the businesses, but not necessarily the individuals needing that service. That's the kind of area I see a challenger eventually breaking through.

Enjoyed reading this article? You can find our other Innovator Interviews here.