Harnessing technology to build an industry leading mortgage processing platform

Canada Life identified an opportunity to lead the equity release market and needed technology to give them an edge

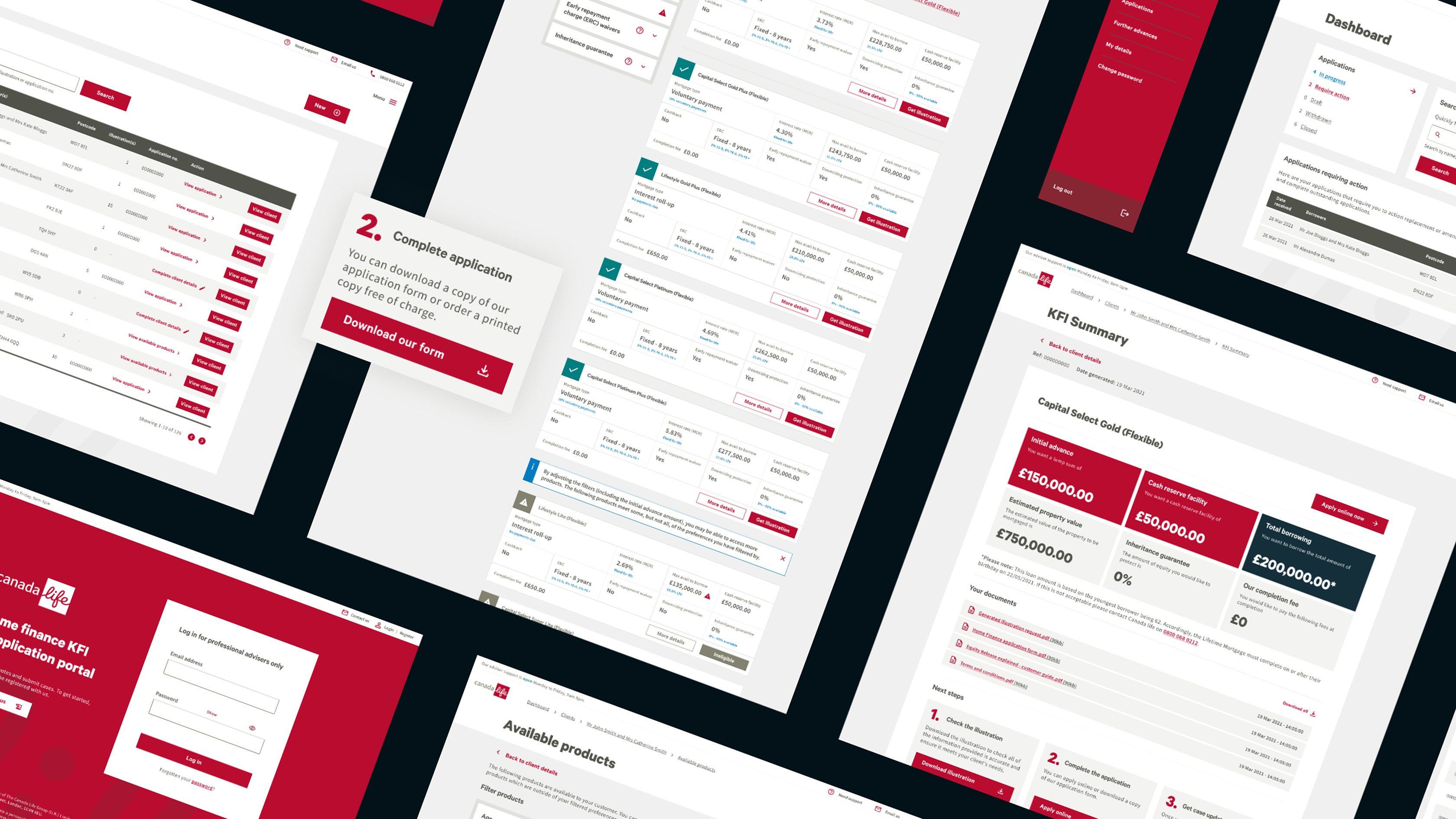

How could we convert a huge number of manual processes and checks that used spreadsheets and fragmented databases to create one platform that could be managed by a much smaller dedicated team?

The Big Idea

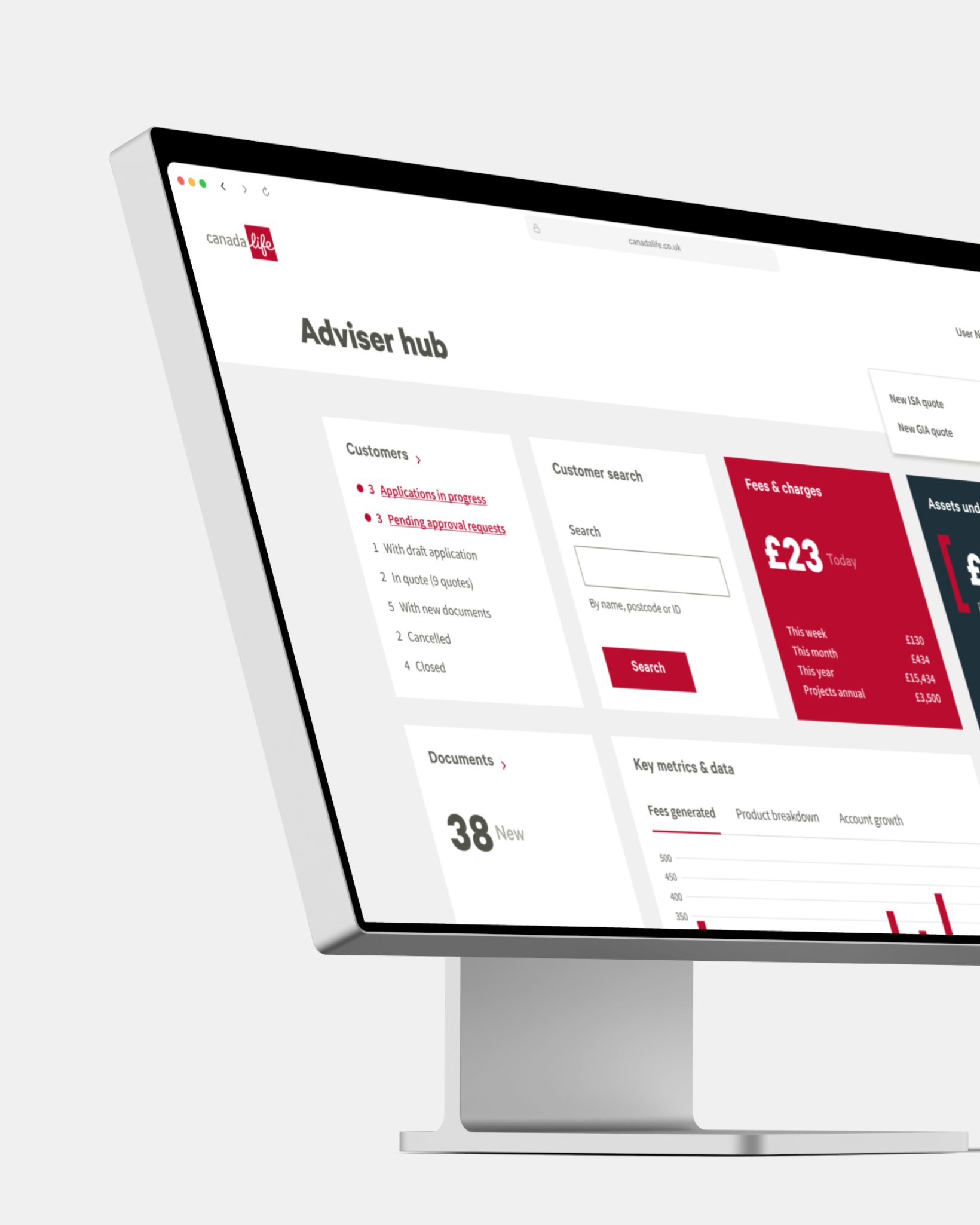

We developed a bespoke digital mortgage management platform, replacing the manual process of the traditional provider with automated workflows and third party integrations. The platform included integrated tools such as online mortgage calculators, online application forms, and API services designed to make everything faster and easier for customers.

Results

Canada Life can now handle more mortgage transactions with fewer people and more flexibility. They‘re competing with the big players and have secured their spot in the industry.

Kind Words

Kyan have helped us build an industry-leading, agile financial processing platform that is highly regarded by our customers.

Chris Green

Head of IT, Canada Life